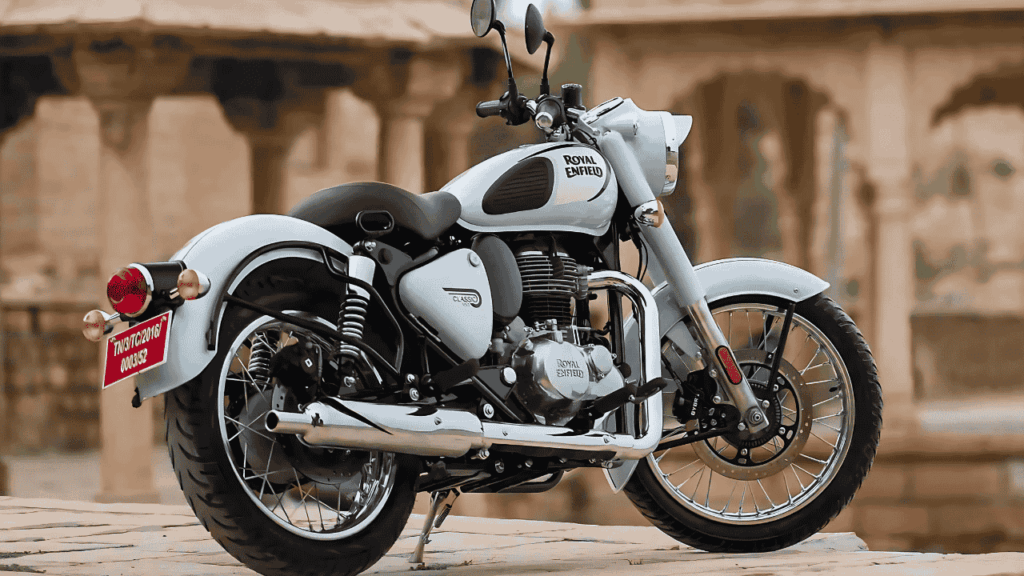

The Royal Enfield Bullet 350 holds immense popularity in India, especially among the youth, making it a top choice for many riders. While its price can be a hurdle for some, it’s possible to purchase this iconic motorcycle with a down payment as low as ₹10,000, provided you have a good credit score. Let’s explore the financing options.

Bringing Home the Bullet 350 with a Small Down Payment

For those who dream of owning a Bullet 350 but find its price a bit steep, financing is a practical solution. You don’t need to pay the full amount upfront. By making a down payment of just ₹10,000, you can take the motorcycle home from the showroom. The on-road price of the Royal Enfield Bullet 350 in Delhi is approximately ₹1,99,950, with similar pricing in other cities across the country.

The Importance of a Good Credit Score

When you make a down payment of ₹10,000, the remaining amount will be covered through a loan. To secure this loan without hassle, it is crucial to have a healthy credit score. A strong credit history demonstrates your financial reliability to the bank, making the loan approval process smoother. This is especially important for individuals who frequently purchase items on credit. Maintaining a good credit score is key to unlocking such financing offers.

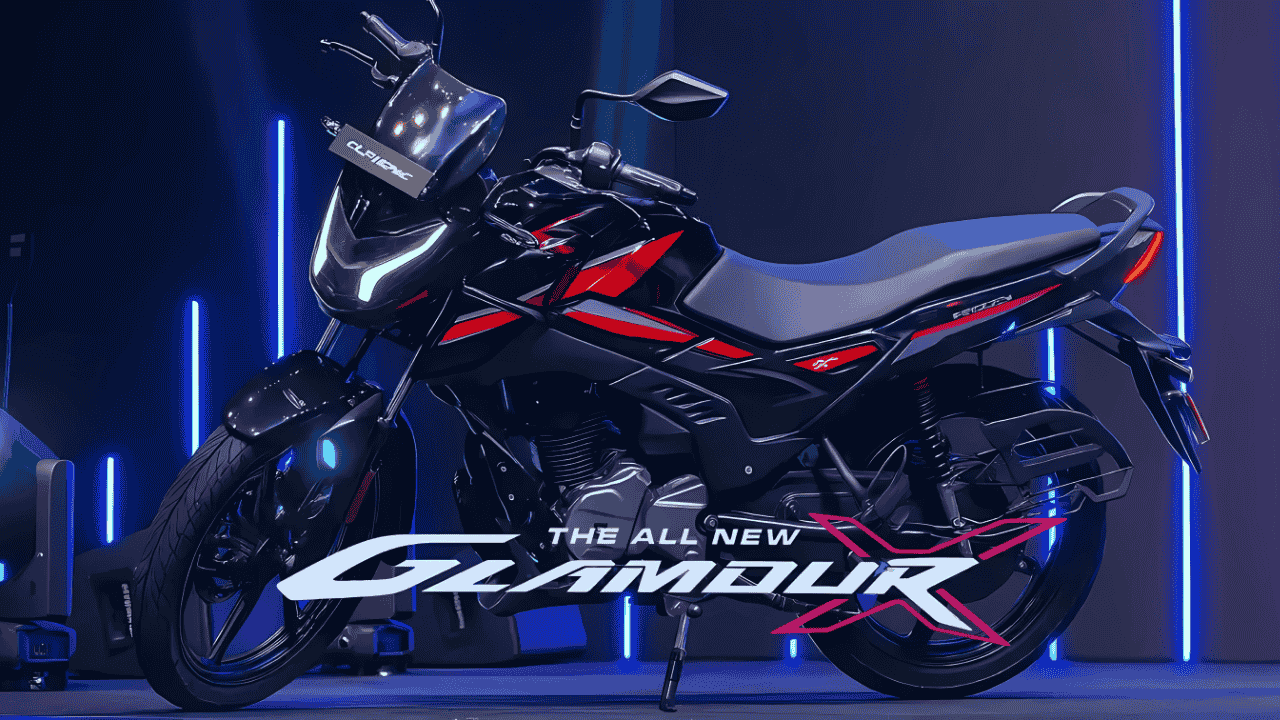

Also Check This: New Hero Glamour X 125: Own It with Just ₹26,679 Down Payment, Check Easy EMI Plans

Calculating the Monthly EMI

Here’s a breakdown of what your monthly payments (EMI) could look like after a ₹10,000 down payment:

- Loan Amount: Approximately ₹1,90,000

- Interest Rate: Assuming an interest rate of 10% per annum.

EMI Options:

- For a 2-year (24 months) loan tenure: You would need to pay a monthly EMI of around ₹9,500.

- For a 3-year (36 months) loan tenure: The monthly EMI would be approximately ₹6,900.

This financing structure makes owning the Bullet 350 more accessible. For instance, if you earn a monthly salary of around ₹30,000, you could realistically plan to bring this legendary bike home.